Generate IR8A AIS Submission

The IR8A Auto Inclusion Scheme (AIS) for Employment Income works when the employers submit their employees’ employment income information to IRAS from 6 Jan to 1 Mar each year. The submitted income information will be auto-included in employees’ tax returns for verification and tax filing.

Now, we can simplify tax filing for your employees with the convenience of a No-Filing Service (NFS).

In Carbonate HR, you can generate IR8A Auto Inclusion Scheme (AIS) Submission easily. But first, the payroll must be generated. Below is the user guide for your reference.

- Kindly take note of the following reminders:

-

1. Round down the amount for “Income” fields that do not accept decimals. For example, the amount of $31220.98 for “Others” in IR8A is to be declared as $31220.

2. Round up the amount for “Deduction” fields that do not accept decimals. For example, the amount of $5566.22 for “CPF contributions” is to be declared as $5567.

- For more details on IRAS, you may refer to this link.

Go to the Singpass.

Login by scanning QR code from Singpass mobile app, or else login using your username and password.

On “Request for Permission”, allow Carbonate app to create connection with your IRAS account.

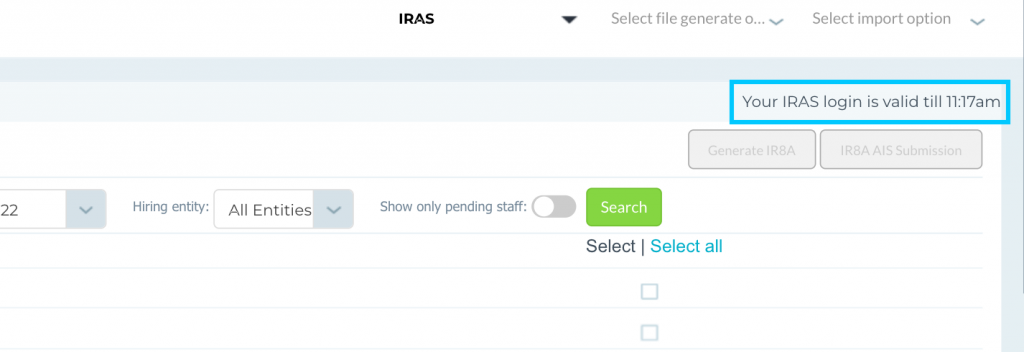

After successful permissions given, it will take you back to the Carbonate IRAS page .

.

Select the employees to be included in the IR8A AIS by ticking the respective box.

You may also select them all at once by clicking Select All.

It is advisable to select all employees from the filter for the submission year.

Data verification:

- Check for the employee details who are skipped for any reason, and those whose data will be successfully pushed.

- Generate IR8A word file to review the income details by clicking on “View IR8A Details”

Click on submit details after the above checks to send data to IRAS through AIS.