A Beginner Guide to Understanding Payroll in Singapore

Every company dedicates a lot of time and energy to finding and hiring the right employee who will take their brand’s efficiency a notch higher. But once an employee is hired, it is the company’s responsibility to keep them motivated and satisfied to get the best out of them. And clearing their payment at the right time, without any delays is one of the best ways of keeping their morale up. Any employee, who dedicates a certain number of hours daily towards their job, expects that they are paid on time, without any glitches. And companies that enjoy the highest retention rate are often the ones that implement a robust payroll system in place.

Payroll is considered to be the single most important HR process for any organization. While most brands across the world ensure they implement a flawless payroll system, organizations in Singapore are known to be the torchbearers of this system. Singapore, which has emerged as one of the most popular business destinations in Southeast Asia, has some specific rules and regulations regarding payroll and all organizations should abide by them.

The payroll process in Singapore has been developed to provide ample benefits to the employees through the payroll tax system. But it’s complicated and crucial since it involves direct financial transactions. So, here is our complete Singapore salary guide that will give you definite and descriptive answers to everything related to payroll in Singapore.

Table of Content

- What is payroll?

- Working Hours in Singapore and Employment Act

- The minimum wage policy in Singapore

- Tax and Social Security

- Leave and Holiday in Singapore

- Steps involving processing payroll & challenges in payroll management

-

What is payroll?

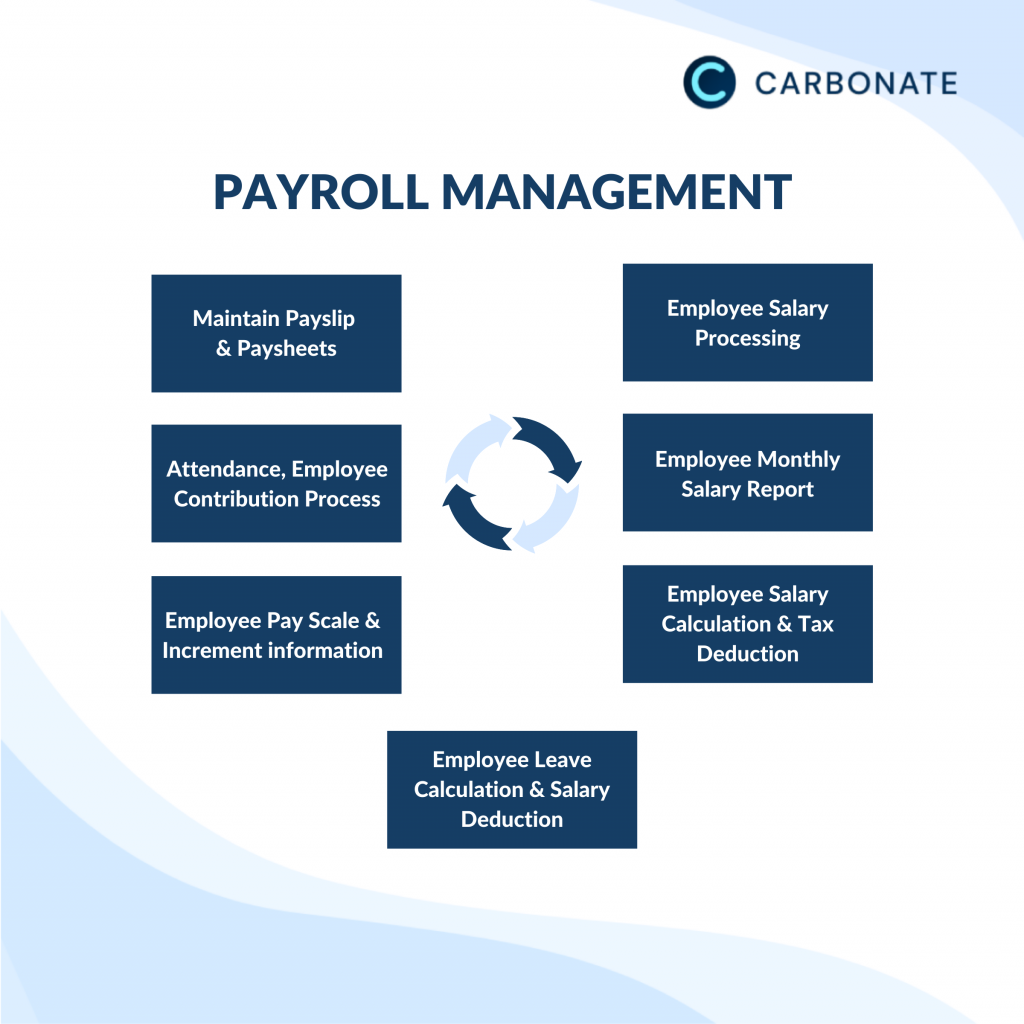

Payroll is one of the most important yet strenuous jobs an organization has to undertake, especially payroll in Singapore as there are some clear rules charted out by the government that need compliance. From managing the payroll records to disbursing them without any glitches, this is a task that requires a lot of hard work. Just like most other countries, payroll in Singapore is not just about having the right knowledge about taxation, CPF, deductions, and rules of compliance. It is a system to keep the employees motivated and enthusiastic to keep performing well. Here are some important points for better payroll management.

- The term salary includes basic wages and allowances that are given to employees in return for their services. These do not include reimbursement for food, lodging, or travel

- Salary must be paid at least once a month, or a shorter period if the employer chooses so. Salaries must be paid within seven days after the end of the salary month. Failure to do this is an offense in Singapore

- The employer should provide a salary slip detailing the basic salary and allowances, date of payment, salary period, overtime if any, leave, and overall deductions

- All employers should have the salary details for tax purposes. A former employee’s salary details should be kept for a year after they resign

- The employees are entitled to be paid 1.5-2 times their original hourly pay as overtime pay in Singapore. The maximum permissible overtime limit is up to 72 hours in a month. The employers should pay the overtime within 14-18 days after the last day of the salary period

- Mandatory skill-based levies, contributions, and other deductions should be accounted for.

-

Working Hours in Singapore and Employment Act

The Employment Act Singapore regulates the working hours and overtime for all employees whose gross salary in Singapore is below SGD 2600 per month. As per Singapore’s Ministry of Manpower, such employees are entitled to work not more than eight hours a day or 44 hours a week, and they should not be allowed to work for more than 6 hours without a break.

Working overtime is also strictly regulated under the Employment Act and no employee is allowed to work for more than 12 hours a day including overtime. But this time limit can be crossed in case of certain exceptions like a threat or an actual accident, working on something essential to national defence or security, or due to unavoidable and unforeseeable circumstances that interrupt the workflow. Those working in shifts are not allowed to work more than 12 hours irrespective of the circumstances. Every employee is entitled to one day off in a week, which is a paid weekly off. The longest duration between two days off is 12 days.

All other employees earning more than SGD 2600 per month are exempted from the Employment Act and they can work out their working hours and other deliverables with their employers.

-

The minimum wage policy in Singapore

Despite having one of the fastest developing business environments in the region, there is no minimum wage in Singapore. The government argues that implementing minimum wages in Singapore will only put more pressure on the employees who will need to upskill themselves to come into the competitive salary bracket. The government also feels that it will increase the cost and ease of doing business, which is something that the government takes very seriously. Instead, Progressive Wage Model (PWM) is followed in Singapore, which means that an employee’s salary will increase as he gets better at his skills in a particular role. But this model is also limited to cleaning, security, and landscape industries.

This salary model leaves employees to create their salary standard basis the sector, their skill set, and how much they can bargain with the employer. Apart from this, an annual bonus is provided by the employers. This bonus is normally equivalent to one month’s salary and is also referred to as the 13th-month payment.

-

Tax and Social Security in Singapore

Just like Progressive Wage Model, Singapore has a progressive tax model as well in place. It simply means that those who earn more will pay more tax. Although the tax rates are considered to be relatively low compared to other countries. The first income bracket of SGD 20,000 is exempted from tax, after which ten bands are applied on different salary brackets. The highest band, that of 22 percent, is applied to those earning more than SGD 320,000 per year. What makes taxation even more effective is that employees are only taxed on income gained by working in Singapore and there is no capital gain or inheritance tax levied. All employers are expected to pay the taxes to the local body Income Revenue Authority of Singapore (IRAS).

Every employer with more than 15 employees must prepare an annual wage report IR8A form and Appendix 8A, Appendix 8B, or fill up the IR8S form wherever applicable. All these documents should be passed to the employees by March 1 of every financial year. Under Singapore’s Income Tax Act and GST Act, all employers should keep a detailed record of employee’s salaries and other deductions that have been submitted to the IRAS every year. Any failure to do so can attract penalties.

Social security in Singapore is handled through Singapore’s Central Provident Fund where the employers and employees must make monthly contributions towards it. The rates vary depending on the employee’s age and if the employee is still in the first two years of getting Singapore’s permanent residence. But most typically, the average rate of CPF for an employee under the age of 55 is 20 percent from the employee’s side, and 17 percent from the employer.

Interestingly, there are no payroll taxes in Singapore. When a non-resident employee terminates the employment, goes for a foreign posting, or leaves Singapore for more than three months, the employer is supposed to inform the tax authorities of all tax details of the employee. This has to be declared a month in advance of the date of termination/departure etc.

-

Leave and Holiday policies in Singapore

There are different types of leave in Singapore. Any employee who is starting a job gets seven days of paid leave in a year, which gradually increases with the service and goes up to 14 days a year from eight years of service. Apart from this, there are normally 11 days of national holidays that employees can enjoy. If any employee has to forgo the national holiday and work on that day, then he is entitled to an extra day’s salary apart from the normal daily pay.

When it comes to sick leave, employees get 14 days for outpatients and 60 days for hospitalization if they have worked for six months in an organization. These leave have to be certified by the company and a government-accredited doctor.

Female employees are entitled to 16 weeks of maternity leave in Singapore – 4 weeks before the delivery and 12 after giving birth. But these leaves are allowed only if the child is a Singaporean citizen and the would-be mother has finished three months of service. As far as childcare leave is concerned, male employees are entitled to avail of two weeks of leave. The father should be married to the mother before childbirth to avail of these provisions.

-

Steps involving processing payroll & challenges in payroll management

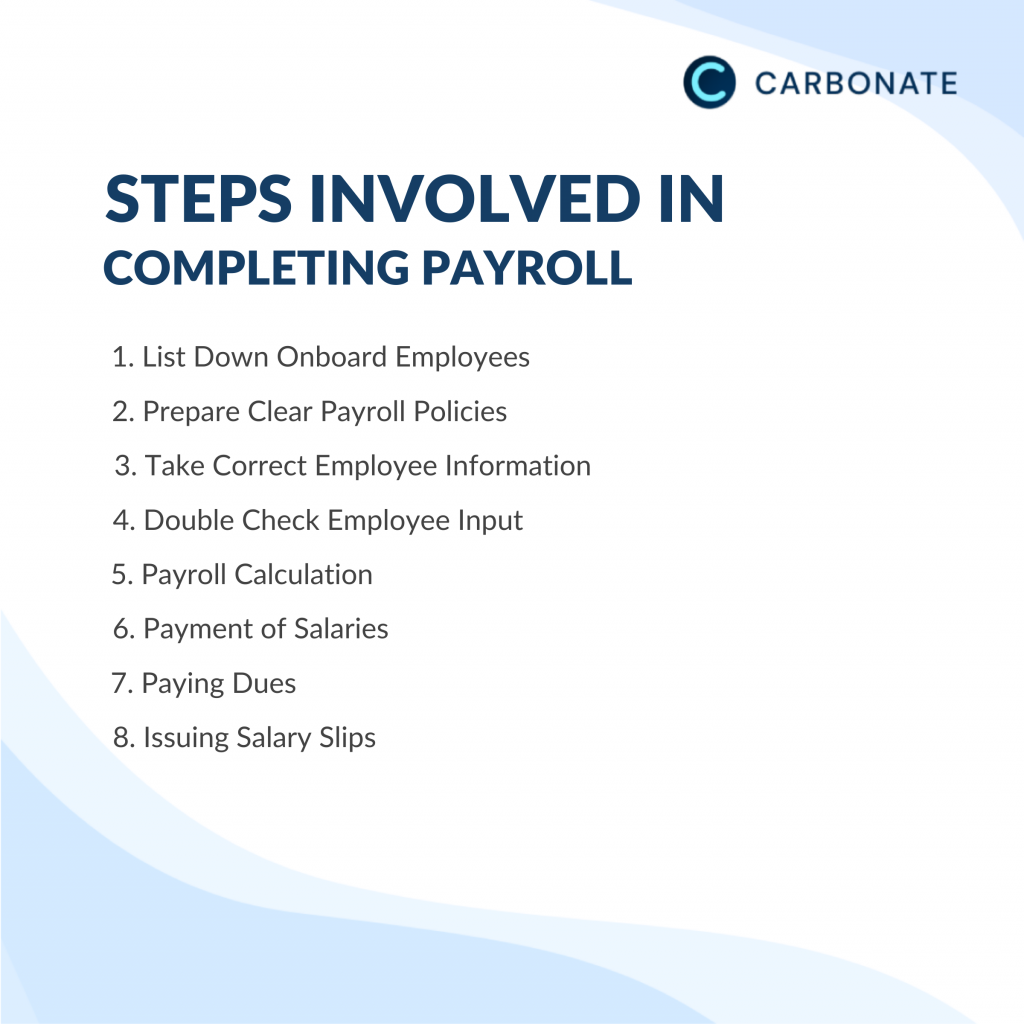

Payroll management is one of the toughest tasks any organization has to go through, and yet it is something that can’t be overlooked. Here are some important points involving processing payroll in Singapore.

- List down onboard employees: Organizations should list down all employees that are on board with them and need to be paid.

- Prepare clear payroll policies: From pay policies, leave management and attendance to employee benefits, organizations should first chart out clear payroll policies and get them approved by the management for a seamless execution.

- Take correct employee information: Details about the employees like bank account details, addresses, etc, should be profiled. This information is really important for payroll processing.

- Double-check employee input: Once all the inputs are recorded, double-check them for validity. Also, ensure that all current employees are listed and no ex-employees are on the payroll list.

- Payroll calculation: The recorded inputs should be fed into the system for payroll processing and net pay is calculated after all the deductions and taxes. It is best to use an automated payroll system to avoid human error.

- Payment of salaries: After the system is loaded with all inputs, salaries are disbursed. This process usually includes companies ensuring they have sufficient balance in their account followed by sending the bank a statement asking them to disburse the salaries. Having an automated payroll system can get this done with just a click of a button.

- Paying the dues: All statutory dues like CPF, the Skill Development Levy, the Foreign Workers Levy, and ethnic funds should be deducted and paid to the concerned government departments.

- Issuing salary slips: All companies are supposed to give all employees salary slips according to the rules of payroll Singapore. This is an important step and should be done on time.

While the process of Payroll Management is fairly linear, there are certain challenges an organization might face. So, here are some of the challenges in the Payroll Management process and how to overcome them:

- Regulatory changes: Keeping up with changing regulations and being in sync for compliance is one of the biggest challenges in payroll management. Organizations should ensure they are updated with the latest regulations and are in compliance with the law at all times.

- Updated employee information: Any changes in employee’s bank account details and other data can be a costly mistake that organizations should avoid at any cost.

- Irregularity in salary payment: Payroll in Singapore has some strict rules in place and any deviations from it can invite penalties. An efficient payroll management system is necessary to avoid such errors.

- Data leak: Most commonly, human errors can result in the leaking of important employee data. It is best to have a fully automated payroll management system to avoid such blunders.

There are several challenges that you might face while handling payroll in Singapore. Such challenges only get amplified if the system is human-driven. The best way to avoid these common errors is to hire a professional service provider who can give you a payroll system that is in sync with the demanding payroll process in Singapore. A simple step of having such a robust system in place can free you from several challenges that might come your way.